StationDigital Corporation – Multimedia Digital Broadcasting

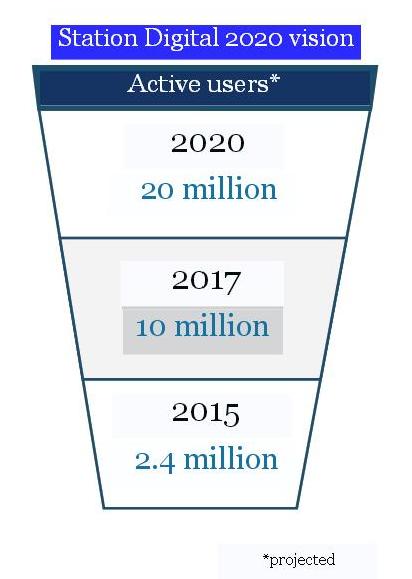

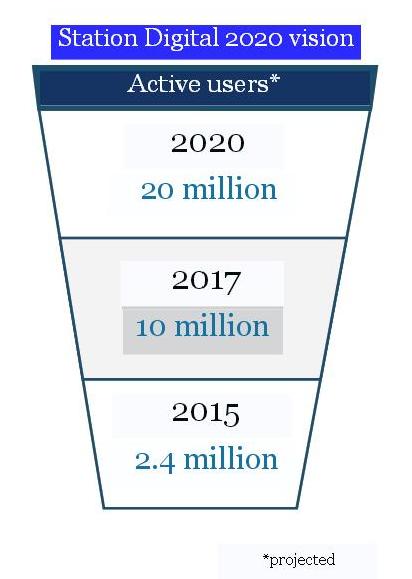

StationDigital, SDIG, is a multimedia digital broadcast company that offers free music streaming of over 30 million songs. StationDigital features both genre-based and artist-based music discovery stations to suit an endless variety of musical tastes, and a personal recommendation service to its more than 2.4 million unique listeners – all available both online and through its iOS and Andriod mobile apps. StationDigital’s users can customize their listening experience by selecting playlists and stations based on themes, interests and location, as well as favorite artists, songs, genre, and by providing feedback on the music they hear.

StationDigital is the first truly next generation digital media broadcast platform.

StationDigital’s primary identity is as a sophisticated pure play music discovery Internet radio service, offering a competitive, state of the art product to capture market share in the Internet radio space. The Company has a unique, industry first value proposition – the StationDigital Listener Rewards Program, where all registered users earn listener rewards points:

> Every time users listen to StationDigital, either on the web or through their mobile apps

> Every time users share StationDigital with friends through social media

Key Features:

Social features and network effect – feedback on music, share music with friends and family, recommendations, post favorites on timeline, and earn reward points. Users can gain followers and build their own music social network of friends and fans.

Unique personalization of music to user’s taste – choose genre, artist, decade and ability to narrow search to a very specific target to get to songs faster. Features include ability to adjust music preferences, create a station playlist, and leverage songs from community of users.

Music discovery – with over 30 million songs and hundreds of stations providing a wide variety of categories and genres, users are always able to discover something new. Add/remove stations with one touch, smooth intuitive song catalog, 30 million songs, choose decade, genre, artist.

StationDigital will become the first agnostic, multimedia, global broadcast platform – available on any device, from anywhere, at anytime.

Investment Highlights

• Opportunity to invest in an innovative, early stage next generation multimedia broadcast company with a unique and differentiated service and business model aimed at a rapidly growing and large market opportunity

• The Company’s music streaming service has over 30 million songs for its 2.4 million users that offers customized listening, music discovery, a personal recommendation engine, a value-added social layer, and e-commerce platform

• Key competitive differentiation factors are its unique listener rewards program/online store and wide variety of entertainment content options beyond music

• Music streaming industry is still in its early stages and is experiencing rapid growth and market share capture from a large addressable $15 billion US radio market

• Our valuation analysis results in a target price of $0.81 per share which represents significant upside of over 2 times the current stock price

see Investment Thesis click here

VALUATION

Starting with Pandora’s market cap per user of $38.63 and then applying a 65% discount to account for Pandora’s first mover advantage, dominant competitive position, and execution track record, we arrived at a market cap per user of $13.52. Based on management’s aggressive marketing plan, it can be estimated that StationDigital will have approximately 5 million monthly active users by the end of 2016. Applying this $13.52 market cap per user to 5 million monthly active user results in a StationDigital target market capitalization of $67.6 million or price per share of $0.81.

Our target price of $0.81 is over 2.0 times the current share price of $0.40 providing significant upside price potential while also being only 35% above the Company’s recent high of $0.60 last October.

learn more about this great opportunity,

download the full research report now! click here

visit the company website www.StationDigitial.com

Start Enjoying the Music You Love!

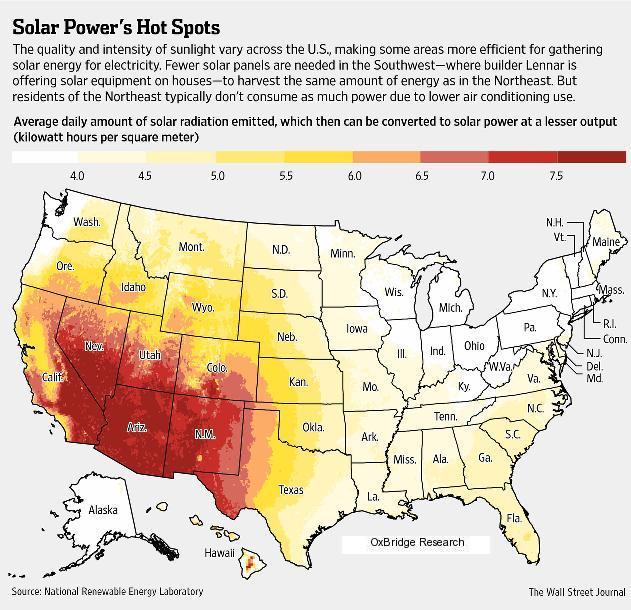

Sources: The Company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you would like your company featured or want to learn more,

please don’t hesitate to contact the Editor. editor [@] OxBridgeResearch.com

music, music streaming, top 10 tracks, top 100 tracks, top 10 songs, top 100 songs, top 40 songs, top country music, top hip hop artists, top performers, top country singers, top female vocalists, top male singers, top on the bill board charts,free music, free downloads, itunes, google music, yahoo music, like spotify, better than pandora, more personal than sound could.

Daily Stock Deals

Daily Stock Deals