NYSE: CIO, EQ, HNP, RMO, MTL,

ICD, KZR, SJ, CAN, LPI

NASDAQ: TRIL, VRTK, ABIT, MOST, VVOS,

GOEV,PXLW, ABVC, ENDP, KLXE

Editor, Daily Stock Deals @TOP10STOCKS

NYSE: CIO, EQ, HNP, RMO, MTL,

ICD, KZR, SJ, CAN, LPI

NASDAQ: TRIL, VRTK, ABIT, MOST, VVOS,

GOEV,PXLW, ABVC, ENDP, KLXE

Editor, Daily Stock Deals @TOP10STOCKS

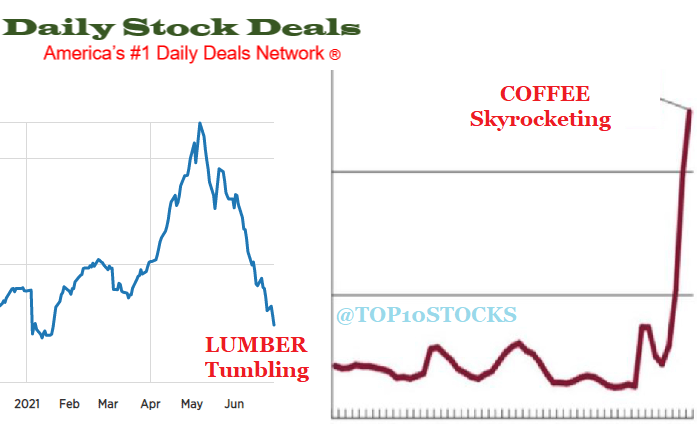

The inflation may look transitory but if you look carefully, you can see there is something highly disturbing and that led us to believe that there is a great chance that the inflation could turn into Transposing, rather than remaining Transitory - switching from one commodity to another – pushing up prices of commodities and could remain embedded in the economy for the foreseeable future, hitting different segment of consumers and businesses at different times, as far as we know, no one knows the exact extent and duration of its impact.

However, the net outcome would be the same and will be felt by the consumers and businesses alike, the prices may remain elevated longer than the Fed’s current expectation and contrary to the predictions of most economists, we think, there is a chance that inflation could rise, higher than the Fed’s target, and could be embedded permanently, denying the low wage earners any meaningful benefit of recent wage gains.

When Inflation turns from Transitory to Transposing, jumping from one commodity to another, as you’ve noticed from Lumber to Coffee for instance, what can the Fed do? Is there a tool to target a specific or a basket of commodities? And you know the answer!

The key question is: how the consumers and businesses adjust to the new reality of unpredictable Transposing Inflation.

Editor Daily Stock Deals

Lumber always felt lonely, growing up in a forest full of trees, contrary to what you think, is not easy, he never met a Hot gal like Copper before, so when Copper complimented him by saying how Handsome and Tall he was, Lumber, for the first time in his life, felt loved and he couldn’t believe his luck that he scored a Hotty! So he ordered Dom Perignon by a dozen and they both got drunk and crashed!

Copper down a $1000 from the peak, the red hot metal losing some luster as the Chinese starting to dump their huge stockpiles. Copper is down 10% and we think it may shed another 5% or more, there is no denying that Copper will play a huge rule in the fast changing economy, but the rapid rise was fueled by unsustainable speculation and bullish bets.

Lumber likewise was one of the best commodity trades of the 2020, pandemic driven exodus to the suburbs, pent up demand and supply constrains all played a rule, but it recently emerged that the Big Builders and Traders were hoarding lumber like never before, now these hoarders are dumping lumber in the market to lock-in gains.

We strongly believe that some of the ‘housing shortage’ you are hearing about has an element of ‘speculation’ and FOMO factor playing a huge rule in the rapid rise in housing prices. These and other pockets of speculation and some real supply constraint are the factors contributing to inflation, which the Fed believe is ‘transitory’ and the Fed has been right to stay the course but remain vigilant.

Editor

Learn how 3 Chinese Robinhoods vying to lure a billion Chinese Traders

The TikTok, tit for tat Trump era saga has ended with a thud! though the political rhetoric between the two largest economies of the world remain tense and highly charged as ever, however, the Chinese investors have never been more bullish on American stocks. In the midst of the 2020 pandemic and widespread lockdowns, the Chinese companies have managed to raise more than $15 billion from American investors, the year 2021 is poised to break all the previous records. A large number of Chinese companies, among them DiDi - the big daddy of them all - are gearing up to list on American Stock Exchanges, Didi Chuxing is one of the highest valued Unicorns in the world.

The Robinhoods of China are making money hand over fist catering to Chinese investors, these new investors are interested in buying stocks in American companies and Chinese companies that are listed on the US & Hong Kong Stock Exchanges.

The Incumbents

1. Futu Holdings, NASDAQ: FUTU is a full service broker dealer based in Hong Kong with operations in many jurisdictions, Futu is backed by one of the largest companies in China and it has a massive $23 billion market cap. Futu and its subsidiaries provide investing services, including stock trading and clearing, margin financing, wealth management, market data and information, and interactive social features for Hong Kong, US, China Connect and Singapore stocks, the company cater to individual investors through two digital platforms: FUTUBULL and MooMoo

https://futuholdings.com/en-us

2. Up Fintech (Tiger Brokerage)

Tiger, NASDAQ: TIGR, Tiger’s platform enables investors to access securities including equities, ETFs, options, futures and funds on multiple global markets including Nasdaq, New York Stock Exchange, Hong Kong Stock Exchange as well as A shares which are tradeable under Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs. Tiger is a fast growing online platform backed by the largest Smartphone manufacturer in China.

The Challenger!

9F Group, JFU (soon) Ether Securities

Ether provides financial technology services, such as credit assessment and consultation services to financial institution and online wealth management services to mid- and high-net-worth clients. Ether also provides online stock investment services and insurance brokerage services in mainland China and Hong Kong and consumer financing technology services in Southeast Asia.

Ether is well known for providing consumer credit and insurance services and that helped the company accumulate a large number of customers over the years and now the company is focusing its attention on the highly lucrative trading/investing business vertical. The company has recently announced that it intend to pivot to the fast growing online stock investing/trading business and planning to change its name to Ether Securities to better reflect the rapidly changing nature of its business.

The stock has been on a tear since the announcement!

And in less than 3 weeks JFU has surged more than 70%.

Ether Securities, with under $600 million market cap, is much smaller than the incumbents but has a huge potential to grow as more Chinese investors join the online trading frenzy sweeping the United States, China and other Southeast Asian countries where JFU already successfully operates.

Learn more about JFU pivot: https://dailystockdeals.com/featured-deals

About Daily Stock Deals

Daily Stock Deal helps emerging growth companies reach individual and institutional investors. Daily Stock Deals and its affiliates publish research reports, market analysis and daily stock picks to help investors make informed decisions and achieve their individual investment goals. Our Platform is directly/indirectly supported by the companies that we profile, therefore, our views are neither free of conflict, nor intended as advise to buy/sell any securities, additionally we as a firm and our staff members own/buy/sell/trade in securities of companies that we feature/discuss on our platform/blogs/socialmedia channels, therefore, we strongly urge you to read our TOS, Disclaimer/Disclosure and consult with qualified experts before investing. However, on the other hand, if you wish to get your company featured on our platform/network or have any question, we would love to hear from you, so please feel free to contact the editor. This email address is being protected from spambots. You need JavaScript enabled to view it.">This email address is being protected from spambots. You need JavaScript enabled to view it.m or DM @TOP10STOCKS thanks!

Copyright©2017 Daily Stock Deals TM,

Today's Top 10 Stocks TM, All Rights Reserved Worldwide.

Daily Stock Deals is a division of Placebo Media Group

Daily Stock Deals

A Sound View Plaza 1266 E Main St. 7th Floor, Stamford, CT 06902 USA

T 214 810 5549

E help@dailystockdeals.com