| IPAS | KUTV | ONTY | BGMD | DVOX | PPHM | STXS | VTUS | CTCH | USAT |

|---|---|---|---|---|---|---|---|---|---|

| 10.94% | 18.11% | 9.68% | 3.91% | -10.38% | 6.61% | 3.79% | 6.74% | 3.72% | 8.97% |

|

|

|

|

|

|

|

|

|

|

Monthly Archives: February 2013

Big Winners, LVVV DAEG ADAT FLML FOLD ANX ARWR IDN CRME DVOX

LVVV 3.71%

DAEG 7.15%

ADAT 12.79%

FLML 12.72%

FOLD 4.53%

ANX 6.87%

ARWR 4.78%

IDN 11.11%

CRME 3.90%

DVOX 37.66%

| LVVV | DAEG | ADAT | FLML | FOLD | ANX | ARWR | IDN | CRME | DVOX |

|---|---|---|---|---|---|---|---|---|---|

| 3.71% | 7.15% | 12.79% | 12.72% | 4.53% | 6.87% | 4.78% | 11.11% | 3.90% | 37.66% |

|

|

|

|

|

|

|

|

|

|

LVVV, LiveWire Ergogenics, Corporate Profile

LiveWire Ergogenics, LVVV, Summary, Profile

LiveWire Energy™ Chews are manufactured in Anaheim, California by LiveWire Ergogenics Inc., the first company to market a full-flavored, soft “energy” chew packed with both B vitamins and up to 120 mg of time-released caffeine.

LiveWire Energy™ Chews are manufactured in Anaheim, California by LiveWire Ergogenics Inc., the first company to market a full-flavored, soft “energy” chew packed with both B vitamins and up to 120 mg of time-released caffeine.

Designed for consumers with an action-packed lifestyle, LiveWire Energy™ chews are pocket-sized, portable alternatives to bulky energy drinks or shots. Available in seven different flavors, the Company’s grab-n-go packaging responsibly displays the amount of caffeine in each chew.

Blazing the trail with a brand new category:

LiveWire Energy’s brilliant strategic move has borne fruit, from the early on the company has decided not to compete head-on for shelf space in the overcrowded cooler section. LiveWire has created a brand new category (LiveWire Energy Chews) and the company is successfully exploiting its first movers advantage and expanding rapidly. LiveWire Energy has been rewarded with a prime spot near the check out counter.

Extensive consumer surveys and marketing intelligence has shown that the consumers love variety and they prefer ‘chew’ over canned energy drinks for convenience and pleasure, LiveWire’s chew delivers the punch at an attractive price point.

LiveWire has the potential to grow even faster because the unique advantage it enjoys at the check out counters of American convenience stores. The products uniqueness and the value pricing model has made the LiveWire Energy Chews an ideal impulse buys.

LiveWire has established a nationwide distribution network and its products are now available in stores across the country, national chains like the 7-Eleven, which has over 10,000 stores in North America, are market testing LiveWire Energy products in multiple stores in various regions of the country, the management believes LiveWire Energy products will be available in 7-Eleven stores across the country in the near future.

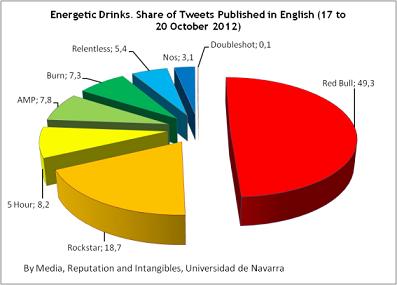

Marketing in the age of Social Media

LVVV markets product though social media outlets such as Facebook, Twitter and YouTube, and the Company also sponsors a range of events Additionally, at events, in videos and in news releases LVVV utilizes its LiveWire Girls and athlete / celebrity endorsers. As outlined in a recent announcement of the appointment of three key market executives, LVVV organizes its marketing efforts regionally as well as functionally with the appointment of a Director of Promotions responsible for promotional events across the country that serve as an opportunity for sampling, education, and marketing. Additionally, LVVV works with consumer products brokers to get access to shelf space as well as continuing its utilization of athlete and other recognized LiveWire Energy Brand Ambassadors.

The potential of LVVV’s marketing approach is evidenced by the recent announcement that the LiveWire Energy chews will be available at 50 Albertson’s in southern California. By focusing on a specific target geography, LVVV can concentrate marketing resources to not only encourage sampling, but to work to retain new customers. With progress made in one market, it seems likely a grocer like Albertson’s would be ready to roll out to new locations.

Athletes Chewing up the competition

LiveWire Energy is proud to get the endorsement and support from well known, highly regarded athletes from various sports, including the NBA star Randy Moss, who helped 49ers get to the super bowl 2013.

Professional boxer Manny Robles III of Los Angeles and race car driver Harley Letner, who is regarded as one of the best drivers in the sport of off-road racing have joined the LiveWire Energy team to chew up the competition on and off the track.

The Opportunity

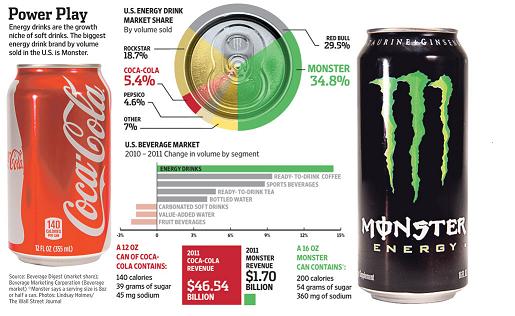

Retail sales of energy drinks in the U.S. increased to an estimated $8.9 billion last year from $7.7 billion in 2010 and now represent more than a tenth of the country’s $75 billion carbonated soft drink market, according to Beverage Digest, a trade publication and data service.

The rapid rise of energy drinks comes as fewer Americans grab colas and traditional sodas. LiveWire Energy is providing consumers a great alternative, better product and the consumers have overwhelmingly embraced it.

Sources: the company, Wall Street Journal, OxBridge Research, Bloomberg, Beverage Network

Disclosure-Disclaimer:- OxBridge Research publishes sponsored research reports, advertorials and corporate profiles. OxBridge Research is not a Broker Dealer or a Registered Financial Adviser in any jurisdiction, whatsoever. All the information published on its website(s) and/or distributed to its members via various electronic means is for general awareness and entertainment purpose only. OxBridge urges investors to do their own due diligence and consult with their financial adviser prior to making any investment decision. We are expecting a payment of five thousand dollars in compensation from the company/a third party/shareholder. We receive compensation from companies for providing various IR services, including publication, advertisement, and social media awareness, therefore our views/opinion are inherently biased. Please read the full disclosure/disclaimer, if you need assistance contact Editor@OxBridgeResearch.com

OxbridgeResearch.com, All Rights Reserved. Trademarks/logos are of their respective owners. It’s YOUR money – Invest WISELYTM

Sequester could help Gold, keep an eye! Gold at $1575 looks very attractive see chart.

SCON, our pick from two weeks ago, Skyrocketed today!

We think the ‘sequester’ will NOT happen, however, if it does, it would have far reaching consequences, Pentagon will be forced to layoff thousands of civilian employees, NIH, the crown jewel of American Health Research will be forced close its labs.

Gold could benefit from the political gridlock, $1575 could be a good entry point, potential upside, $15 to $35 dollars.

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!® Get the Fresh, Nutrient Rich, Piping Hot Picks Everyday! Sign-up, its FREE!

The Great Weed Crash, Pot stocks got crushed, MJNA lost 40% in 5 days, PHOT down 25%, CBIS, HEMP all DOWN.

Medical Marijuana, Inc. (MJNA)

-OTC Markets 02/20/2013

0.2890 0.0310(9.69%) 4:00PM EST

| Prev Close: | 0.32 |

|---|---|

| Open: | 0.33 |

| Bid: | N/A |

| Ask: | N/A |

| 1y Target Est: | N/A |

| Beta: | N/A |

| Next Earnings Date: | N/A |

| Day’s Range: | 0.2510 – 0.33 |

|---|---|

| 52wk Range: | 0.02 – 0.50 |

| Volume: | 31,331,714 |

| Avg Vol (3m): | 15,191,100 |

| Market Cap: | 212.83M |

Our Pick Chelsea, CHTP, skyrocketed today! whopping 151% Gains!

| MOTR | SIGA | GEVO | OTT | TZYM | HEB | GSX | VALV | SYN | CHTP |

| 5.24% | 2.13% | 6.11% | 0.67% | 8.09% | 4.55% | -4.63% | 3.51% | 2.56% | 7.79% |

|

|

|

|

|

|

|

|

|

|

4 Healthcare Stocks, all under $1, you don’t wanna miss! IDRA, CPRX, ULGX, OCLS

Get Today’s Top 10 Picks for FREE!

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!® Get the Fresh, Nutrient Rich, Piping Hot Picks Everyday! Sign-up, its FREE!

ToTOP Solar Stock Picks for 02/19/2013, YGE, JASO, SOL, STP, HSOL, cheap solar panels leasing options Solar City,SCTY

Solar Stocks rising, more homeowners opting for lease, easy and affordable buying options increasing the solar foot print, companies like Solar City and Sun Power are poised to rake-in huge cash.

Solar installers are doing a brisk business in California and other states, subsidies, credits and other incentives are driving the growth. SolarCity, the new $1.5 billion solar kid on the block and other companies are benefiting from the new business model.

Top Solar Stocks picks for 02/19/2013, YGE, JASO, SOL, STP, HSOL

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!®Get the Fresh, Nutrient Rich, Piping Hot Picks Everyday! Sign-up, its FREE!

How Soros made $1 billion on one Yen Trade, Forex Trading gone wild, currency traders hit jackpot with USD/JPY pair. If George can do, so can you.

If George can do, so can you! If Soros Can Make $1 Billion on Yen Trade, You can too?

It was Soros second $1 billion dollar trade. Soros pocketed cool billion dollars on each trade,once betting against a central bank, this time betting with the central bank.

Nobody should be surprised that a bunch of hedge-fund boys piggybacked onto Shinzo Abe’s campaign pledge to drive down the yen. What is surprising are the fantastic sums people like George Soros cleared in just a couple of months, and if the new Japanese prime minister gets his man in at the Bank of Japan, the easy yen trade may have legs.

Wagering against the yen has emerged as the hottest trade on Wall Street over the past three months. George Soros, who made a fortune shorting the British pound in the 1990s, has scored gains of almost $1 billion on the trade since November, according to people with knowledge of the firm’s positions. Others reaping big trading profits by riding the yen down include David Einhorn’s Greenlight Capital, Daniel Loeb’s Third Point LLC and Kyle Bass’s Hayman Capital Management LP, investors say.

When names like Soros, Einhorn, Loeb, and Bass, and a figure like $1 billion, get attached to a trade, you can imagine that mere mortals will start salivating. But can little guys maneuver like the likes of Soros? Is this trade a rent, or a buy? Also, not for nothing, but if the story’s on the front page of the Wall Street Journal, will that alone wreck the trade, as it’s now out there for anybody and everybody to see, and crowd into? Are Soros and the rest already selling?

Learn more: http://www.oxbridgeresearch.com/

Marijuana, MJNA, reached the tipping point, market cap a whopping $360 million dollars! Top pot picks, MJNA, PHOT, CBIS, HEMP

$MJNA at historic highs, market cap a whopping $360 million dollars!

Pot hysteria reaches epic proportion $MJNA $PHOT $CBIS $HEMP

Don’t miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!® Get the Fresh, Nutrient Rich, Piping Hot Picks Everyday! Sign-up, its FREE!