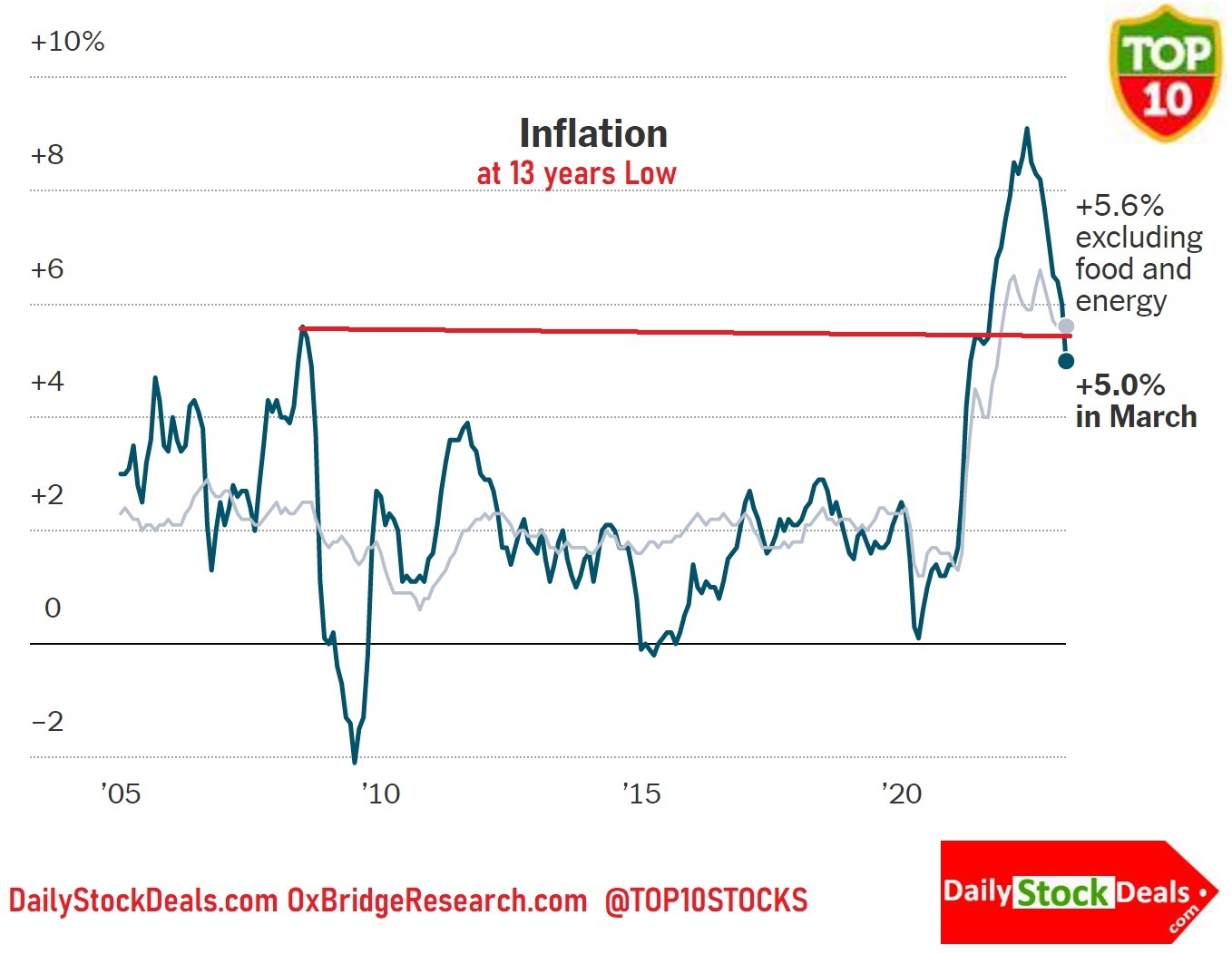

Core Inflation is what the Fed cares about the most.

Then the Fed has to take a closer look at the Real Estate! yeah, that's a big one.

However, for Americans it's the everyday stuff that matters like: Bread, Cereals, Fruits & Vegetables.

Let’s find out where is our money going

1. The index for cereals and bakery products rose 13.6 percent.

2. Fruits and Vegetables rose 11.3 percent.

3. The food consumed at home rose 8.4%

4. Restaurants jacked up food prices by 8%

The Core inflation slightly increased from February to 5.6% - is that a big deal? May be – May be not – But Fed can’t take a chance when the trajectory is pointing upwards.

Banking Crisis largely contained but has not vanished completely – they may slowly simmer into the summer – then evaporate?

Real Estate is the Biggest Risk right now – Commercial Real Estate and Multifamily homes.

From the Biggest behemoths like Blackstone to the local versions of HGTV types who promised to double your money and provide steady 'passive' income.

When the interest rates were near Zero everyone looked so ridiculously brilliant – now they are looking just ridiculous!

One such outfit in Houston lost a whopping 3,200 Apartments last week!

The bank has foreclosed on them. Why? The old stubborn cashflow – not enough cash to pay the mortgage.

Another one is trying to sell 40% of their portfolio – Blackstone is negotiating with its bankers/landlords too.

The Fed will take all that into consideration, and I think a quarter in the next meeting in May is more likely, then Jay Powell will take a much-deserved early summer vacation!

Editor, Daily Stock Deals

For timely, actionable and potentially profitable news and uncensored views:> sign up for FREE in 15 seconds

Keep an eye on this space for major announcements!

Reminder: Free Membership enables immediate access to @TOP10STOCKS a great way to start your trading day

Source: The Company, OxBridge Research, Daily Stock Deals, PennyStockIQ