Saturday, March 11th, 2023

Analysis & Commentary on Banking Crisis

Here is how the Fed can solve the Banking Crisis in 3 Easy & Simple Steps

-

1. The Solution: Reverse Credit Default Swaps (RCDS)

-

2. The Purpose: To Hold Securities to Maturity

-

3. The Taxpayers will Not be on The Hook!

Reverse Credit Default Swap, how the RCDS work? And who will pay?

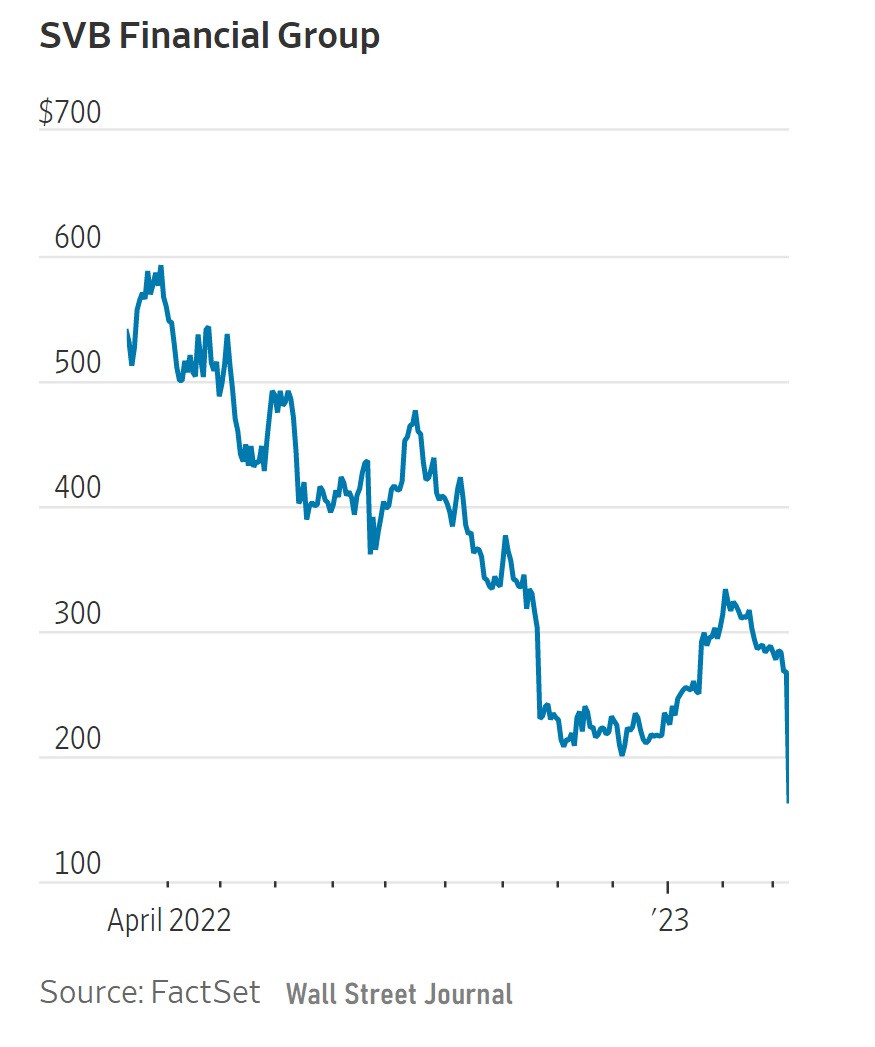

The Fed will create the facility and swap securities held by SVB dollar for dollar at face value (plus any losses the bank has suffered due to the rapid, unexpected interest rate hikes) in lieu of providing the temporary liquidity the Fed will be compensated and the Taxpayers will not be on the hook.

For back stopping the securities, the Fed will receive equity or warrants in the bank, and we’ve a good framework and a precedent for setting up such a facility, the Fed has done this before with the Fannie Mae, the only difference is that the SVB is a private sector bank, but the logic is the same. Stopping the contagion in its tracks and preventing bank runs at Smaller Banks and Credit Unions can’t be underestimated.

-

The Fed can opt to receive equity or warrants for incurring any losses (mostly loss of interest income).

-

The Fed will hold securities for 3 years or less.

As it is widely believed by economists and Fed watchers that the interest rates will revert to where they were.

Why should we put Taxpayers money at risk?

If the Fed is going to hold the securities until maturity only, then the risk is very insignificant (potential loss of interest income only).

The most important reason that we need to do this is to save our banking system from being hijacked by a few Big Banks, that would further disenfranchise consumers living in small cities and towns across America, failure to do so will deny access to credit to folks who can least afford, small banks and community banks play a vital role in communities and they are essential for local businesses.

The Fed’s quick action can not only prevent bank runs but also it will restore confidence in our banking system and preserve the local, smaller lending institutions that are so essential for communities. If we let this crisis linger, it would have devastating effect on American Banking System, and we will end up with a few behemoths accumulating assets along with catastrophic risk that can devastate communities across the country.

The Editor

Penny Stock Bank

@PennyStockBank

From The Editor of Daily Stock Deals:

For timely, actionable and potentially profitable news and uncensored views:> sign up for FREE in 15 seconds

Keep an eye on this space for major announcements!

Reminder: Free Membership enables immediate access to @TOP10STOCKS a great way to start your trading day.

You may also like these stories: